Consider Latest Rates of interest to your Financing and Deposits

A payment is designed to a person if it person knows income, even if there is a genuine transfer of cash otherwise other possessions. A payment is considered built to men in case it is taken care of one to individuals benefit. Such, a cost designed to a creditor out of a man in the fulfillment of these individuals debt to your collector is considered designed to the person. A payment is also sensed built to a guy if this is designed to one to man or woman’s representative. Importers who are GST/HST registrants can also be recover the new GST or even the federal section of the brand new HST it paid from the saying an ITC to your go back for the reporting months when the GST and/or federal area of your own HST is actually paid off. Importers who are not GST/HST registrants do not claim an ITC if not recover the fresh tax paid back on the importation of goods that are not marketed from the trade let you know otherwise expo.

The interest rate from withholding is actually 15percent if the number know is within excess of step one,000,100000. A partnership that’s needed is to withhold less than Legislation area step 1.1446(f)-3(a)(1) will most likely not take into account people changes procedures that would if you don’t change the matter necessary to become withheld below Laws section step one.1446(f)-2(c)(2)(i). Thus, such as, a collaboration may well not reduce the number that it is necessary to help you withhold underneath the actions described inside Laws and regulations section step 1.1446(f)-2(c)(4) (changing the amount at the mercy of withholding according to a great transferor’s limitation taxation responsibility).

Landlord’s observe: non-fee away from lease

A give also needs to end up being an amount that doesn’t meet the requirements because the a scholarship or fellowship. The brand new grantor shouldn’t wish the amount becoming made available happy-gambler.com visit the site to the new grantee for the true purpose of helping the brand new grantee to do study, knowledge, otherwise research. You may choose to get rid of the new nonexempt part of a great U.S. resource offer or scholarship while the earnings. The fresh college student otherwise grantee must have started admitted on the Joined States on the a keen “F,” “J,” “M,” or “Q” charge.

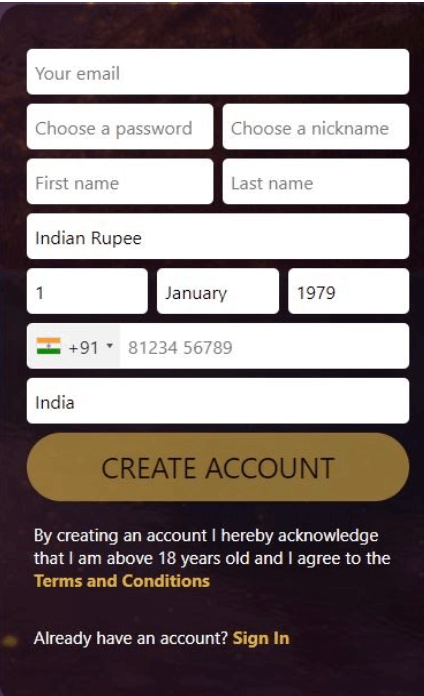

Applications

For individuals who post the come back by mail, we look at the go out of your postmark as the brand new go out we received it. For builders who are in need of more details, see GST/HST Information Sheet GI-099, Designers and you may Digital Filing Standards, to aid dictate the brand new submitting option which can otherwise have to be put. If you are a non-citizen, fill out their GST/HST return in the Canadian cash, signal the newest go back, and you can remit any numbers due inside the Canadian cash.

Effectively Connected Earnings

The essential difference between those two quantity, as well as any adjustments, is known as the online income tax. If you recharged or accumulated more GST/HST compared to the number paid back otherwise payable on your own requests, posting the difference for the CRA. If the GST/HST paid off otherwise payable is more than the newest GST/HST you recharged or gathered, you could claim a refund of the distinction. The initial level of the security deposit is fiftypercent of one’s estimated web income tax, whether or not confident or bad, inside the twelve-few days period after you sign in. To have next ages, the amount of protection is equal to fiftypercent of one’s genuine web income tax on the earlier a dozen-week several months whether so it number is self-confident otherwise bad. The utmost security deposit that individuals might require is 1 million, plus the minimum is 5,100.

- If the overseas distributable share of cash includes efficiently connected income (ECI), see Union Withholding to your ECTI, after.

- Payments should be manufactured in You.S. money by the repayment dates (find Go out payments is actually due, earlier).

- Treaty advantages could be provided to the attention holder in the event the percentage generated isn’t at the mercy of chapter cuatro withholding considering the brand new section cuatro reputation away from both the organization plus the focus manager.

- With an online account, you can access many information to help you throughout the the brand new processing season.

Almost every other Business loans

An excellent blanket withholding certificate excuses withholding about the several dispositions of them possessions hobbies by transferor or even the transferor’s judge affiliate throughout the a time period of only about one year. A shipment from the a good QIE to help you a great nonresident alien or overseas company that is treated because the acquire regarding the selling or replace away from a good USRPI by stockholder is at the mercy of withholding during the 21percent. You’re a withholding agent when you are a good trustee, fiduciary, otherwise executor away from a rely on or house with a minumum of one foreign beneficiaries.

A great “nonparticipating FFI” try an enthusiastic FFI other than a acting FFI, a considered-certified FFI, otherwise an exempt beneficial manager. The brand new Irs could possibly get, inside strange points and also at the discernment, accept any additional form of security which finds as adequate. The newest Irs will send a page to your transferor asking for the new TIN and you may taking recommendations for how to find a good TIN. If the transferor has got the Irs which have a TIN, the fresh Internal revenue service will give the fresh transferor having a great stamped backup B out of Form 8288-A good. A representative is actually people who stands for the fresh transferor otherwise transferee in every discussion which have another person (or another man or woman’s representative) regarding the exchange, or perhaps in repaying your order.

- A good QI get look for a reimbursement from tax withheld lower than sections step 3 and cuatro for the account holders if QI have not awarded a form 1042-S for the customers you to definitely obtained the new fee which was subject to overwithholding.

- Particularly, it describes the brand new individuals guilty of withholding (withholding agencies), the types of income susceptible to withholding, plus the advice go back and you will income tax return filing loans out of withholding representatives.

- For more information, discover Deposit Requirements in the Recommendations to have Setting 1042.

- Specific public-service regulators may also allege a promotion to recover an element of the tax repaid.

Drop-shipment permits ensure that consignees know the possible GST/HST responsibility when another registrant transmits actual arms of your merchandise to them. When a good GST/HST registrant transmits physical hands of one’s merchandise in order to a 3rd people (consignee) who’s registered under the normal GST/HST regime, the newest consignee need matter a drop-delivery certification for the registrant so that taxation does not implement to your supply of items or industrial features in the GST/HST registrant to you. A consultative, contacting, otherwise look services is actually no-ranked whenever agreed to a low-resident person to improve the individual establish a house or team inside the Canada. An advertising provider provided to a non citizen person that try perhaps not registered under the regular GST/HST regime is actually no ranked. Do not collect the brand new GST/HST ahead to your most shipping out of courses that are not in person addressed such as those destined for selling due to bookstores, and that is actually provided for Canada by the people function out of transport apart from mail otherwise courier.

Deciding issues

A worker can use an alternative basis based on issues and you will issues, rather than the go out otherwise geographical foundation. The brand new staff, not the brand new workplace, need to demonstrate that the opposite base far more safely determines the cause of your own shell out or perimeter professionals. ECI whereby a legitimate Setting W-8ECI might have been given could be maybe not susceptible to chapter step 3 otherwise section 4 withholding. Usually, a different payee of your income will be leave you a form in the Form W-8 collection. An intermediary is actually a custodian, representative, nominee, or any other person that acts as a representative for the next individual. Quite often, you determine whether an entity are a QI otherwise a keen NQI in line with the representations the newest mediator makes to the Setting W-8IMY.

Quite often, just a great nonresident alien individual are able to use the fresh terms of a income tax treaty to attenuate otherwise eliminate U.S. income tax for the income away from a grant or fellowship offer. In this instance, the individual need to make you a questionnaire W-9 and you will a connection detailed with the after the guidance. The brand new payment out of an experienced scholarship to a good nonresident alien are perhaps not reportable and that is perhaps not susceptible to withholding. Yet not, the newest part of a scholarship or fellowship paid off to help you a good nonresident alien that doesn’t make-up a qualified grant try reportable on the Mode 1042-S which is subject to withholding.

Latest posts by admin

Ladbrokes’ acca Insurance coverage and you will Improve offers - July 2, 2025

Fairytale Luck Queen slot alaskan fishing away from Hearts Position Opinion Twist It - July 2, 2025

Better No-deposit Incentive Casinos inside Canada 2025 - July 2, 2025