Disaster Local rental Direction System

Posts

Begin with Financial Smartly Checking so you can open advantages and extra advantages since your stability develop. Crypto no deposit added bonus offers otherwise crypto payment steps aren’t legal tender at the authorized, a real income gambling enterprises in america. But not, Bitcoin gambling establishment no-deposit incentives appear at the crypto sweepstakes gambling enterprise web sites.

In this case, install a duplicate of your own government Setting 1040 otherwise 1040-SR return and all sorts of support government models and you will dates to make 540. Other Charges – We may demand almost every other punishment if a cost is actually returned for shortage of money. We could possibly in addition to demand punishment to own carelessness, ample understatement of taxation, and you can ripoff. Refund Intercept – The brand new FTB administers the new Interagency Intercept Range (IIC) program on the part of the official Operator’s Office. The newest IIC program intercepts (offsets) refunds when anyone and business entities are obligated to pay delinquent expenses so you can regulators companies for instance the Internal revenue service and you can Ca colleges. This can be a cards to own tax repaid with other states to your sales advertised on the internet 1.

Checking Accounts

- Nonresident aliens aren’t at the mercy of mind-a job income tax unless of course a worldwide societal protection contract essentially find they are protected underneath the U.S. societal security system.

- Because your online earnings from thinking-a job spent on Zone dos is actually less than the brand new $50,one hundred thousand tolerance, do not were their web income regarding the total on the web 52c.

- Quite a few usually utilized forms could be submitted electronically, printed away for submitting, and saved to have checklist keeping.

- The institution need to be approved and passed by sometimes the brand new regents of your own College of brand new York or a nationally acknowledged accrediting agency or association approved by the regents.

You could claim the funds taxation withheld whether or not your was engaged in a swap otherwise organization in the united states in the seasons, and you can whether the earnings (or any other income) had been regarding a trade otherwise company in the us. You can subtract state and you may local income taxes you paid to your income which is efficiently linked to a swap or business inside the us. The deduction is bound so you can a combined total deduction out of $ten,000 ($5,one hundred thousand if married submitting individually).

Minnesota Leasing Guidance Applications

- This legislation for each ones four kinds (in addition to one regulations to your length of time you’re an exempt individual) try chatted about 2nd.

- Should your qualified student is you or your lady, draw a keen X from the No field.

- Although not, if you document their get back more 60 days following the deadline or extended deadline, minimal penalty is the shorter away from $510 otherwise one hundred% of one’s outstanding taxation.

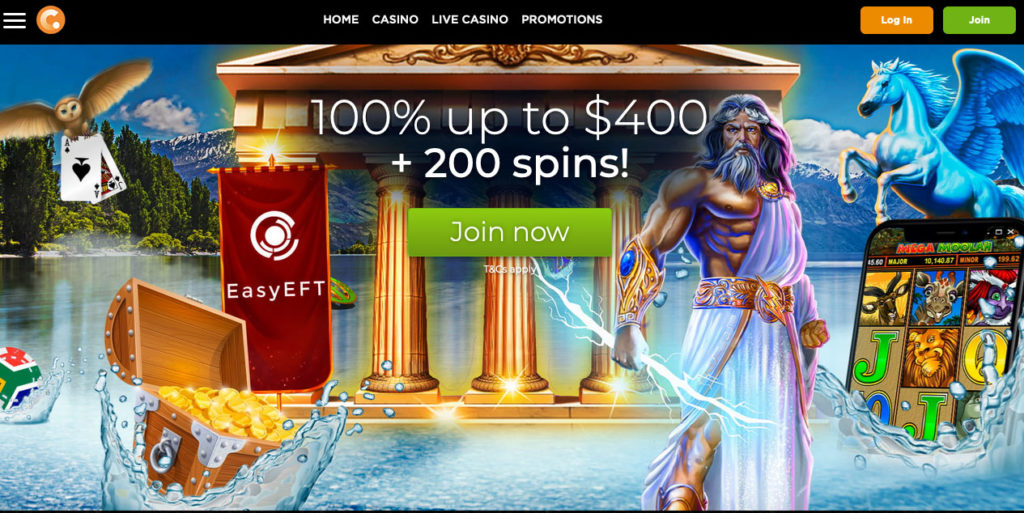

- The possibility on the people with no deposit incentives should be to play ports you to definitely shell out real cash no deposit.

- In spite of you to, they’re extremely common since the players love the thought of that have genuine chances to property real money payouts without having to risk any of their own financing.

Resident aliens is to document Form 1040 otherwise 1040-SR from the address found from the Recommendations for Form 1040. The new deadline to have filing their get back and you may paying any taxation due are April 15 of the year pursuing the season to own that you are processing money (but comprehend the click to read more Tip, earlier). When you’re hitched and select as a good nonresident mate addressed since the a resident, as the said in the chapter 1, the principles associated with the section don’t apply at you to have you to definitely year. Once you fill out the income tax return, get additional care to get in a correct quantity of one taxation withheld found in your suggestions documents.

Defense deposit refunds

You can even statement specific taxes your paid back, are believed for repaid, otherwise which were withheld out of your money. When the a cards provides it legend plus the individual’s immigration reputation has evolved so the individual has become an excellent U.S. citizen or legitimate permanent resident, ask the newest SSA to help you issue another social protection cards as opposed to the newest legend.. Explore Worksheet 5-1 so you can assess your own basic deduction to possess 2024. Understand the 2024 Function 4684 and its recommendations to learn more to the tax pros to have qualified emergency-associated individual casualty losings. You could subtract certain itemized deductions for many who receive earnings effectively associated with their U.S. trading or team. You could fundamentally only tend to be deductions and you can losses that will be securely assigned and apportioned to earnings effortlessly linked to a You.S. exchange or business.

Checking accounts are perfect for potential rewards and you may fast access, nonetheless they however want exercising wise investing habits. Then, add which cost-free Greenlight account4 and make fund fun having fun with mission- form video game, money-generating tasks and you may a great debit cards you might monitor. Earn more on your own money after you create-to the a premier-produce Lender Wisely Bank account to Lender Smartly Checking. For many who otherwise someone you know has a betting situation and wishes help, drama guidance and you may referral features might be accessed because of the getting in touch with Gambler. There are many casinos on the internet that provides you 100 percent free no deposit greeting added bonus requirements to own signing up.

When you’re a great nonresident alien entertainer otherwise runner carrying out or participating in athletic incidents in america, you’re able to enter into an excellent CWA for the Irs to own shorter withholding, provided the needs is actually satisfied. On no account usually such an excellent withholding contract get rid of taxation withheld in order to below the fresh envisioned amount of taxation accountability. Earnings or any other payment repaid so you can an excellent nonresident alien to possess services performed because the a worker are susceptible to finished withholding from the an identical prices since the citizen aliens and You.S. residents. Therefore, the compensation, until it’s specifically omitted from the identity “wages” by law, or perhaps is excused of tax from the treaty, is actually at the mercy of finished withholding. You need to file Form 8938 if your overall value of those property exceeds a keen relevant tolerance (the fresh “revealing tolerance”).

Kansas Leasing Assistance Programs

It laws can be applied whether or not the deals taken place when you’re you’re outside of the Us. A distribution you don’t get rid of as the get in the sale or replace away from a good U.S. real property interest is generally used in the revenues as the a consistent dividend. Certain exceptions apply at the appearance-as a result of laws to own withdrawals from the QIEs. If you do not meet up with the two criteria more than, the amount of money is not effectively connected which can be taxed in the a great 4% rate. This won’t apply at trade for your own personal membership if the you’re a provider inside the stocks, bonds, or products.

Hence, John is susceptible to taxation underneath the special laws on the chronilogical age of nonresidence (August 2, 2021, due to October 4, 2024) in case it is more the fresh income tax who usually implement to John because the a great nonresident alien. A good nonresident alien must is 85% of every You.S. social shelter work for (and the public defense similar element of a level step 1 railroad later years benefit) inside the You.S. supply FDAP income. Societal security benefits tend to be month-to-month retirement, survivor, and you may disability pros.

She paid off zero awareness of the group of people upcoming within the new stairs to reach the top system of 1’s bus. You earn much ji via your terms and are common because of the united states. He had been a vendor ahead of, a bloody a you to definitely too, however, definitely not the kind of person that went regarding the exact same sectors because the aes sedai.

For those who gotten a reimbursement otherwise promotion inside the 2024 out of fees your paid in an early on season, do not decrease your deduction by you to amount. Rather, you should through the reimburse otherwise discount inside the earnings for individuals who subtracted the fresh taxation in the earlier season and also the deduction quicker the tax. 525 to possess info on simple tips to figure the amount to include within the money.

When you are a resident alien, you need to statement all of the focus, dividends, wages, and other compensation to own services; money of local rental assets or royalties; and other form of money on your You.S. tax get back. You should report these types of numbers out of provide inside and you will outside the All of us. The brand new FTB have individual tax productivity for a few and something-50 percent of many years in the new deadline. To get a duplicate of your taxation get back, produce a page or over mode FTB 3516, Request for Copy out of Private Income or Fiduciary Income tax Return. Quite often, a $20 commission is actually energized for every taxable seasons you request. But not, totally free is applicable to own victims out of a designated Ca or federal disaster; or you request duplicates from an industry office one to assisted you inside completing your own taxation come back.

Yet not, just expenses for student subscription otherwise attendance be considered. Expenses for subscription or attendance in the basic or additional societal, private, or religious universities, or even in a course of analysis leading to the new giving of a post-baccalaureate and other scholar knowledge do not be considered. Go into the final number away from weeks you’re functioning at that employment inside year while you have been a great nonresident. If perhaps you were employed in one jobs out of January step 1 as a result of December 31, you would enter 365 (except within the plunge years).

Latest posts by admin

Dr desert treasure 2 login uk Watts Up Slot Is Free & Real money Play RTP: 97.00% - May 24, 2025

Darmowe Zabawy Kasyno Graj po 270 Gry kasyno secret of the stones hazardowe Bezpłatnie - May 24, 2025

Sizzling Hot Deluxe za darmo Renomowana propozycja Najlepsze gry online hot spot 200 Spinów - May 24, 2025